Some rules of thumb for evaluating startups

This is an ongoing compilation of metrics for tracking and benchmarking tech startups…

SaaS Growth Benchmarks

T2D3 – The expectation that companies should triple the first two years after reaching $1M ARR and double the next three years comes from this article

Mendoza Line for SaaS Growth – Bad things happen when a company’s growth rate falls below the Mendoza Line

The Growth Rate Mirage – Different formulas can produce a wide range of growth rates making it difficult to compare early stage companies. (Growth rates converge over time as companies get bigger). Here, the Scale iCAGR is introduced:

SaaS Sales Efficiency Benchmarks

These efficiency scores compiled by Bessemer Venture Partners are similar. Here’s how I think about them from most relevant to least:

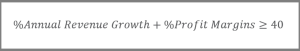

The Rule of 40 (slide 30)

Efficiency Rule (slide 35)

Efficiency Score (again, slide 30) should be above 75% for pre-IPO companies.

Evaluating Marketplaces (Qualitative)

All Marketplaces Are Not Created Equal – Bill Gurley distils success for marketplaces into 10 key factors:

New Experience vs. the Status Quo

Economic Advantages vs. the Status Quo

Opportunity for Technology to Add Value

High Fragmentation

Friction of Supplier Sign-Up

Size of the Market Opportunity

Expand the Market

Frequency

Payment Flow

Network Effects

20/20/20 Rule – This rule of thumb provides a quick gut-check regarding the viability of the much simpler, back of the napkin approach to evaluating marketplaces: Do they provide…

20% cheaper services for consumers with same utility?

20% more income for service providers?

20% margins?

The post Some rules of thumb for evaluating startups appeared first on Ramping up.